Your support helps us tell the story

From reproductive rights to climate change to big tech, The Independent is on the ground when the story is developing. Whether it’s investigating the finances of Elon Musk’s pro-Trump PAC or producing our latest documentary, ‘The A Word,’ which shines a light on American women fighting for reproductive rights, we know the importance of analyzing the facts of messaging. .

At such a critical moment in American history, we need reporters on the ground. Your donation allows us to continue sending journalists to tell both sides of the story.

The Independent is trusted by Americans across the political spectrum. And unlike many other quality news outlets, we choose not to block Americans from our reporting and analysis with a paywall. We believe that quality journalism should be available to everyone, and paid for by those who can afford it.

Your support makes a difference.

The rise in inflation last month likely to mean higher borrowing costs for longer periods of time.

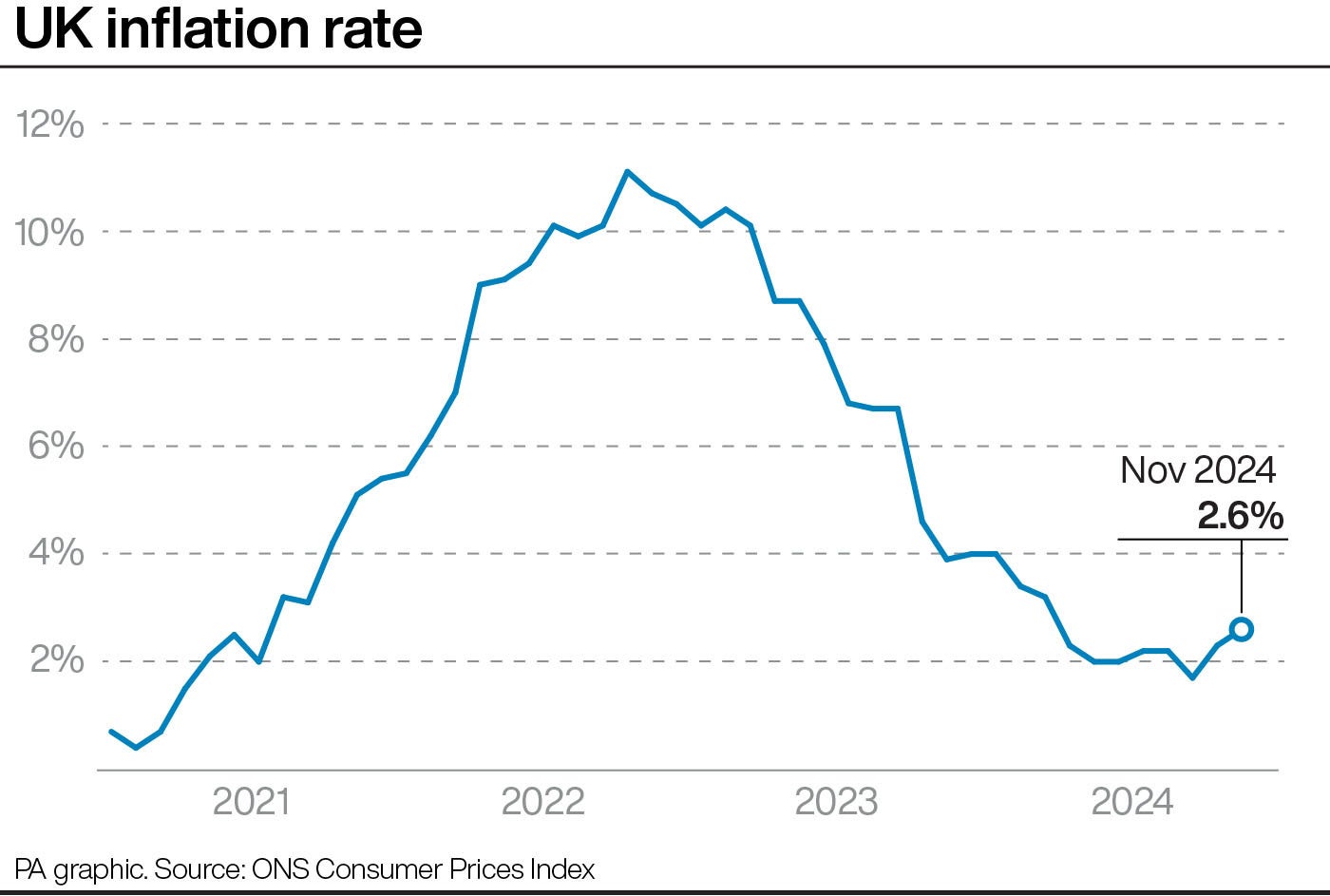

Prices rose at a faster pace of 2.6 percent in November, compared to 2.3 percent in October.

Faster growth in consumer goods prices such as food and energy put inflation outside the Bank of England’s 2 percent target rate, meaning a rate cut is unlikely, economists say.

Petrol prices, train travel and products such as margarine and eggs contributed the most to the price increase, the Office for National Statistics said.

The Bank of England is meeting to decide whether to cut interest rates again after cutting its base rate to 4.75 percent last month. Stubborn inflation will make that unlikely when the decision is announced on Thursday.

Monica George Michael, associate economist at the National Institute for Economic and Social Research, said: “We expect the MPC to keep rates on hold at tomorrow’s meeting and gradually cut rates in 2025.

“However, we think the Bank will remain cautious given the elevated wage growth, global uncertainty surrounding the Trump presidency and inflationary pressures introduced in the latest budget. Interest rates may therefore remain higher for longer than previously thought.”

The UK economy shrank in October. The ONS said last week that output fell by 0.1 per cent after a 0.1 per cent fall in September, raising the specter of a quarter cut if growth does not return.

The poor figures led shadow business secretary Andrew Griffith to claim the UK could already be in recession.

He said Sky News: “If this was an airplane and there were so many dials in the minus, you’d be looking for a parachute. I think we may already be in a recession.”

The rise in prices comes after a series of other bad data. Figures released on Tuesday showed job vacancies fell by 31,000 to 818,000 in the three months to November, and the number of people on UK payrolls fell by 35,000 to 30.4 million between October and November.

Sarah Coles, head of personal finance at stockbroker Hargreaves Lansdown, said: “Inflation is staying put for now, like an unwelcome guest at a Christmas party pushing the sofa into the wee hours. The question is, can it be moved, or will it hang around to screw up our plans for months – eating us out of house and home and driving up the cost of everything again.

“Food and beverage price inflation rose to 2%. Poor harvests in a number of areas have boosted prices of trolley favourites, including olive oil, by 26.6 per cent on the year and chocolate by 9.9 per cent.”

New figures revealed today will also add to the gloom. The volume of manufacturing output fell at the fastest pace since mid-2020, according to the Confederation of British Industry, a business lobby group.

Manufacturing of automobiles, glass, ceramics, furniture and upholstery led the decline, the CBI said.

Its survey of 331 manufacturers said production fell 25 percent in the three months to December.

Ben Jones, CBI chief economist, said: “Manufacturers are facing a perfect storm of weakening external demand on the one hand, amid political instability in some key European markets and uncertainty over US trade policy. And on the other hand, domestic business security collapsed in the wake of the budget, driving up costs and leading to widespread reports of project cancellations and falling orders.”

The Bank of England raised interest rates to 5.25 percent last year, taking them to the highest rates before the Great Financial Crisis of 2007-2008. It then cut interest rates to 5 percent in August this year.

Commercial lenders use the bank’s prime rate as a guide on how much to charge borrowers and how much to reward savers.

Money market traders delayed their rate cut expectations until May. Previous market activity has suggested that a cut could come in March.